Estate Planning

More than tax

Estate planning is an act of self-respect. Self-respect to treat your wealth, which you have gathered with slow and painful patience with the seriousness it merits: seriousness to protect it for future generations.

Estate planning is the art of arranging your assets and income so that only those you wish to benefit from your life’s work do so.

Estate planning is the science of arranging your assets so that your money stays in your family not merely for one generation, but till the rocks of Gibraltar have crumbled. This science is how the rich stay rich.

Ade was wonderful. Very diligent, empathetic, and communicative, and went above and beyond for us.

Estate planning, inheritance tax planning and probate assistance

More than will writing in a fancy red dress or a Saville Row suit, estate planning is an act of honesty, honesty of your ambitions for your family.

Estate planning

The art of arranging your assets and income so that only those you want benefit from the fruit of your life’s work do. You can control who benefits from your wealth both in your lifetime, and after your death.

Probate assistance

Estate administration is the art of carrying out the terms of the will [or intestacy] in the manner that suits the beneficiaries best.

Inheritance tax planning

Speak to an expert who knows all the 251 rules, exemptions and allowances to inheritance tax who would draw up a plan specific to you.

Estate planning in action

My grandmother and her twin brother, my great uncle Albert, split half a million pounds, the proceeds of selling a cloth distribution enterprise, equally between them. When they died in the late 1980s, each of them passed on that quarter million-pound wedge in their estates.

First, my great uncle Albert...

His estate paid inheritance tax at 40% therefore his daughter, my aunt inherited only £150,000. My aunt got divorced in what turned out to be the last year of her life – on her divorce, half of her £150,000 walked on her divorce. Therefore, she had only £75,000 of the original quarter million to pass on to her children.

Now my grandmother...

By the bolts and nuts of her estate planning when my grandmother died, her daughter, my mum had full use of the £250,000. Because granny had done the hard work, now my mother has died, I today have unrestricted access to the £250,000, and when I die, my daughter would have the full £250,000.

How would you rather arrange your affairs, like my grandmother, or like my great uncle Albert?

Not every future member of your family wants or needs to be a multi-millionaire. However, you have it in your gift to lay the foundations so youryou family may rise as high as they wish or they could. You and I know those who attain the jobs that our society accords the greatest rewards tend to come from wealthier backgrounds.

Estate planning uses several tools including inheritance tax planning, lifetime gifting and wills to interpret the relevant rules, regulations and legislation to your circumstances. So, you may control who benefits from your wealth both in your lifetime and after your death.

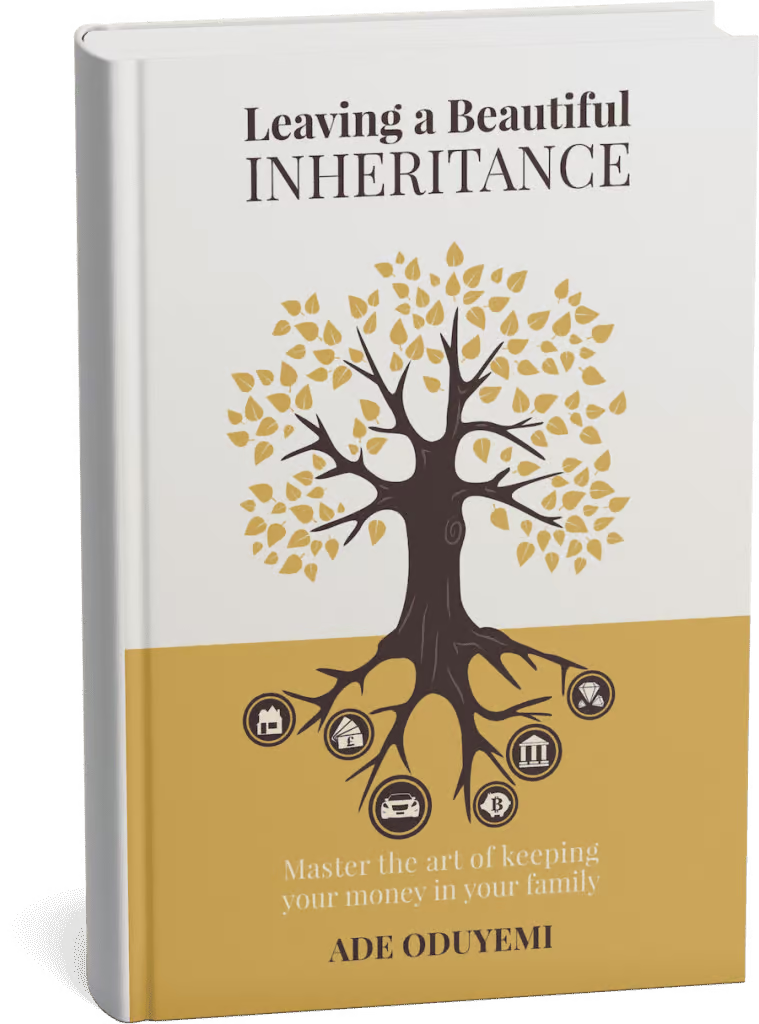

I wrote the book…

Maximum Inheritance

Drawing on my experience as an inheritance tax specialist, I wrote the book on making the most of your inheritance.

Get your free paperback copy of Maximum Inheritance – an easy to read volume of anecdotes and thumbnail sketches of cases I’ve witnessed in my extensive career as an inheritance planner and will draughtsman. It would open your eyes to what to look out for when writing your will and planning your inheritance.

Frequently Asked Questions

How does a will differ from estate planning?

A will is just one of the tools of estate planning. Estate planning would arrange your assets so you and your beneficiaries enjoy them both in your lifetime and after your death.

If all you had were a will, you’d be leaving things to chance – you’ll be giving random amounts of money at a random time to random people: you don’t know when you or your beneficiaries would die.

Estate planning including inheritance tax planning, will writing and gifting assets in your lifetime aims to arrange your assets so that on your death the inheritance tax liability on your estate is as close to zero as possible. Further, your estate would be protected from the wicks and straws that leach your money from your family.

Merely writing a will exposes your estate to several threats to your family’s financial well-being, for instance, such that if you left a child a quarter of a million pounds which is enough to buy a Rolls-Royce, in three generations it would have turned by the magic of inter-generational inheritance tax to £54,000.

In three further generations, it would have turned into enough to buy a motorcycle. So, you have it in your power, which would you want your grandchildren and future generations of your family to have, the Rolls Royce, the Mini… or the motorcycle.

What is the difference between Estate Planning and Inheritance Tax Planning?

Inheritance tax planning and estate planning are two sides of the same coin, it is impossible to do one without the other. The difference is a matter of your starting point in the task of keeping your money in your family.

While concentrating on which of your relatives and descendants would inherit your assets, we think of who would get which assets and under which circumstance. By this calculation, I would highlight the points at which the girls and boys from the revenue would lie in wait – with the tried and tested routes to manage and reduce inheritance tax.

If your primary concern was inheritance tax, we would understand that the important part of inheritance tax was the question of what the assets under discussion were, and who benefited from them.

Your Family’s Financial Future

Not every future member of your family wants to be or needs to be a multi-millionaire. However, it’s in your gift to provide the foundations for future generations of your family to lead comfortable lives based on professions and vocations they enjoy and are committed to – it’s in your gift to provide future generations the means to, quit the rat race, or better still, never to have entered the rat race – if they so wish.

How to Turn a Rolls Royce to a Mini

If you had £250,000 – a sum just about enough to buy a Rolls Royce – if you gave that sum to your child, and it was handed down 2 further generations, the evil effect of inheritance tax would reduce £250,000, enough to buy a Rolls Royce to £54,000 enough to buy a Mini. Without estate planning, you’d have condemned your family to burn nearly £200,000 at the altar of inheritance tax. You need me not to tell you about unfair taxation – what they don’t waste, they steal.

In the final analysis, which would you rather leave to your grandchildren and great-grandchildren – the Rolls Royce or the Mini?

Keep your money in your family

Get your free copy of the No-nonsense Guide to Keeping Your Money in Your Family: you’ll also get witty and informative articles and essays on keeping your money in your family. It’s packed with illustrations you can understand and relate to.

Ade was so informative, respectful and kind in his procedure. I highly recommend to anyone this service.