Inheritance tax is a voluntary tax.

It’s a simple matter of whether or not you wish to keep your money in your family.

The Problem Inheritance Tax Planning Prevents

- Do you fear the fruit of your life’s family’s work would be gobbled up in future generations inheritance tax payments?

What is Probate?

Probate is permission from the courts to handle the estate of the deceased.

If the deceased person left a will, the permission document issued is a grant of probate. If the deceased left no will, the permission document is called letters of administration.

When someone dies, those managing their estate pay any inheritance tax due, and may apply to the HM Courts and Tribunals Service to obtain the grant of probate.

Depending on the nature and value of the deceased assets a grant of probate may not be required.

What is Estate Administration?

Estate administration is the art of passing the estate of the person who has died to the appropriate beneficiaries.

When estate administration is done expertly, the beneficiaries of the estate either through a will is there is one, or by the rules of intestacy if there is no will would be certain that the value of the estate, remained in their family forever: safe from the threats that ensnare and entrap estates small or large up and down the land.

What is the Importance of Estate Administration?

When estate administration is done by a master of his craft, the beneficiaries of the deceased’s estate would enjoy two principal benefits:

- they would be confident all relevant rules of administering the deceased’s estate have been followed, all the hassle would have been taken off their hands, and

- they would have paid the absolute minimum of inheritance tax – not a penny more.

Grant of Probate or Letters of Administration?

If the deceased left a will, the courts would issue a grant of probate.

If the deceased did not leave a will, the courts would issue letters of administration.

What is a Deed of Variation?

Sometimes it is necessary to change who gets the assets in the estate, so that certain beneficiaries or potential beneficiaries are better provided for – especially if there is no will. Inheritance tax often depends on who is benefiting from an estate. Changing the beneficiaries of an estate can result in a lower inheritance tax bill.

A deed of variation is a document that allows the change of beneficiaries.

How Long Does Probate Take?

Obtaining a grant of probate typically takes 8 -12 weeks.

The estate administration process would typically take a year. This depends on the nature, composition and location of the assets.

This also depends on their being no dispute among beneficiaries or potential beneficiaries.

How Much Does Probate Cost?

Estate administration when done properly, when done by an expert estate administrator, depending on the measures the now deceased person had put in place, and depending on the size and complexity of the estate would cost between 1% and 3% of the gross estate.

What is a Person's Estate?

A person’s estate comprises, but is not limited to:

- The value of assets in a person’s outright ownership.

- The value of the person’s half share of any assets jointly owned as joint tenants.

- The value of the person’s percentage share of any assets jointly owned as tenants in common.

- The capital value of any trust in which the person has a qualifying interest in possession (QIIP).

- The value of any assets given away in the person’s lifetime which are still subject to a gift with reservation of benefit

- The value of assets given away in the seven years preceding death; while not part of the deceased’s estate, this is brought into account in calculating inheritance tax on death.

Effect of Inheritance Tax

If you had £250,000 – a sum just about enough to buy a Rolls Royce, if you gave that sum to your child, and it was handed down 2 further generations, the evil effect of inheritance tax would reduce £250,000, enough to buy a Rolls Royce to £54,000 enough to buy a Mini. Without inheritance tax planning, you’d have condemned your family to burn nearly £200,000 at the altar of inheritance tax. You need me not tell you about unfair taxation – what they don’t waste, they steal.

Of course, with expert inheritance tax planning, you can, and should prevent future generations of your family paying inheritance tax on this estate.

Rolls Royce or Mini?

In the final analysis, which would you rather leave to your grandchildren and great grandchildren – the Rolls Royce or the Mini?

Benefits of Estate Planning

Not everyone wants to be or needs to be a multi-millionaire. However, it’s in your gift to provide the foundations for future generations of your family to lead comfortable lives based on professions and vocations they enjoy and are committed to – it’s in your gift to use this inheritance to provide future generations of your family the means to, quit the rat race, or better still, never to have entered the rat race – if they so wish.

Ignorance, T’is no Excuse

It’s a shame that you’ve not been informed of how to overcome the wicks and straws that can drain your family’s inheritance, but this is your opportunity to secure your inheritance.

Doing nothing to protect your family’s inheritance is not a crime exactly, you can’t be sent to prison for it, but it’s a crying shame.

Your Family’s Future

In the final analysis, after all is said and done, the most fundamental, the most serious question that could come before your consideration is this: where, two, three and further generations from now would you like your family to be ranked socially, financially and even morally?

You know as well as I do that all that is good, morally, financially and socially in this country is so much easier achieved if one has had the benefit of inherited wealth which is often the key to an independent education.

The Sum of the Parts

Inheritance tax planning is more than just the sum of the parts, it’s more than just a collection of tools such as gifting, allowances, wills, deeds of variation of which you might have heard.

Inheritance tax planning is more than the sum of its parts.

With inheritance tax advice you’ll get an easy-to-follow plan that is tailored to your family and financial circumstances. The plan would ensure you retain control of who gets the fruit of your inheritance work and under what circumstances.

Inheritance Tax Planning & You

You’ll be recognised by your family from the next generation onwards for providing the keys to freedom from the rat race, for freedom to allow them do fulfilling work, be it nursing, teaching, or social work because their material comforts have been taken care of.

Our Desires & Responsibilities

Inheritance tax planning helps you fulfil that centuries old desire that our children, and every subsequent generation of our family would be better off than we are.

Remember, from reading this inheritance tax planning FAQ, estate panning is an act of honesty, an act of ambition, an act of honesty of ambition, therefore, which would you hand to your grandchildren and great-grandchildren, a Rolls-Royce or a Mini?

Other Things I Can Help You With

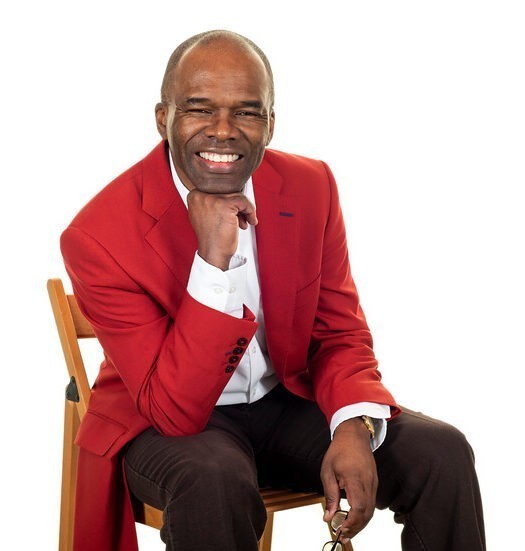

My Approach to IHT Planning

You’ve seen several reviews and recommendations – they reflect the care, diligence and experience I invest in my clients.

Your family’s unique, therefore your estate planning should be unique, no off-the-peg nonsense.

You’re the expert on your family’s matters – every family is special in its own way, therefore I’ll bend my extensive experience to your situation. I can see round corners, so I can spot possible problems and prevent them before they germinate.

A proud sole-practitioner, I start every relationship with a blank sheet of paper. I write all my planning documents by hand, no cut and paste. No forms, no tick-boxes, no templates. No cut-and-paste. I start every relationship with a blank sheet of paper.

Contact

020 8669 1779

18, Salisbury House, 8 Melbourne Rd, Wallington SM6 8SA