Inheritance Trusts

A trust is a legal entity that dates from the times of the Crusades, that holds assets on behalf of individuals when they are unable to hold the assets themselves or when the original owner thinks it undesirable that the beneficiaries should hold the assets in their own name. Although assets are held by the trusts, the beneficiaries would enjoy the benefits of the trust.

We talk here of testamentary trusts.

Stella in writing her will, left her entire estate to her twin niece and nephew, Janet and John, but Stella died on the twins’ 17th birthday, as they are children, they cannot hold property therefore their gift in their aunt’s will would be held in trust till they were adults. Such trusts are automatic – if Stella had died after the twins had passed their 18th birthday, the estate would have passed to the twins. The trusts would not have been formed. All the assets would have been in their names.

Testamentary Trusts

Inheritance trusts are a central inheritance planning device best illustrated by examining what happens in their absence. We talk here of trusts that are formed when the person writing a will has written them specifically into the will, and would be formed, irrespective of the age of the person getting the gift in the will.

Inheritance Trusts & Divorce

Most estates are left to the beneficiaries ‘absolutely’. Mark leaving his one-million-pound estate to his daughter Danica is unremarkable. This however makes Danica, a million pounds wealthier. Imagine Danica’s husband brought divorce proceedings, you’d be surprised if he didn’t ask the million-pound inheritance to be taken into consideration in the divorce settlement.

Inheritance Trusts & Inheritance Tax

If Danica held on to her inheritance – invested it and passed it on to her own children, the children would pay inheritance tax on the million pounds – they would get only £600,000.

These are two of the several threats to inheritances that trusts can overcome.

Types of Trusts

There are several types of inheritance trusts, however we concerned here with testamentary trusts – these are trusts that are written with your will. There are discretionary trusts, interest in possession trusts, there are life insurance trusts, disabled beneficiary trusts.

Ask not what your trust is called, but what you want from your inheritance. The best trust for you would depend on your family and financial circumstances on the one hand and if where you want your family to be ranked socially and financially two three or generations hence on the other.

Full Information on Trusts

Just submit your name and email below to get information on trusts: the types of trusts, the technicalities of trusts, the parties to the trusts – including the trustees, donors and beneficiaries – what inheritance trusts can do for your family, and most importantly, how they can help keep your wealth in your family, not just for one or two generations, but forever.

Other Things I Can Help You With

My Approach to Estate Planning

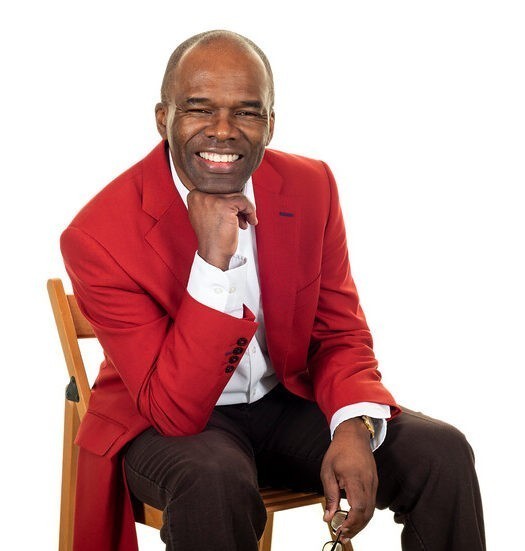

You’ve seen several reviews and recommendations – they reflect the care, diligence and experience I invest in my clients.

Your family’s unique, therefore your estate planning should be unique, no off-the-peg nonsense.

You’re the expert on your family’s matters – every family is special in its own way, therefore I’ll bend my extensive experience to your situation. I can see round corners, so I can spot possible problems and prevent them before they germinate.

A proud sole-practitioner, I start every relationship with a blank sheet of paper. I write all my planning documents by hand, no cut and paste. No forms, no tick-boxes, no templates. No cut-and-paste. I start every relationship with a blank sheet of paper.

Contact

020 8669 1779

18, Salisbury House, 8 Melbourne Rd, Wallington SM6 8SA